Getting The What Is Medigap To Work

Rumored Buzz on What Is Medigap

Table of ContentsA Biased View of MedigapSome Ideas on What Is Medigap You Need To KnowIndicators on What Is Medigap You Need To Know8 Simple Techniques For Medigap BenefitsAll about Medigap

You will certainly need to talk with a certified Medicare representative for pricing and also schedule. It is highly suggested that you purchase a Medigap plan during your six-month Medigap open enrollment period which begins the month you turn 65 and are enrolled in Medicare Component B (Medical Insurance) - What is Medigap. During that time, you can acquire any type of Medigap policy marketed in your state, even if you have pre-existing problems.You may have to get a more expensive policy later on, or you may not be able to get a Medigap policy in any way. There is no assurance an insurer will certainly offer you Medigap if you get protection outside your open registration duration. When you have made a decision which Medigap plan satisfies your needs, it's time to discover which insurance provider market Medigap policies in your state.

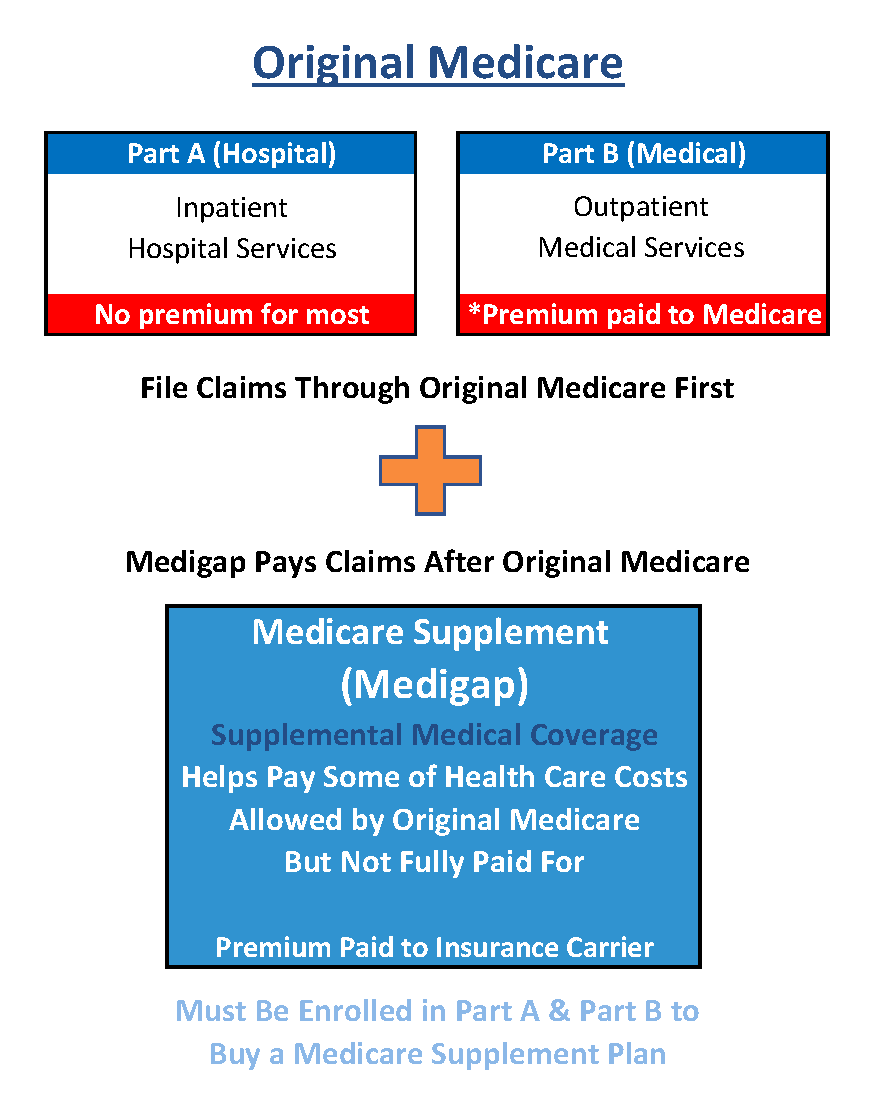

Called Medicare Supplement, Medigap insurance policy plans assistance fill up in the "voids" in Original Medicare by covering a portion of the out-of-pocket costs Over after Medicare Component A and B protection. The specific insurance coverages depend on the kind of plan that is bought and also which state you reside in.

Generally, Medigap insurance providers function with Original Medicare and each strategy type supplies the very same benefits, also across insurance firms. In many states, Medicare supplement plans are named A with N. Tabulation, Expand, Collapse When checking out Medigap plans, you might also check out Medicare Advantage prepares additionally called Medicare Component C.

The Of Medigap Benefits

Medicare supplement insurance policy, on the other hand, is an enhancement to your existing Original Medicare plan. Medigap plans only can be integrated with Initial Medicare and also not Medicare Advantage. Medigap policies are standardized as well as recognized by letters, and need to follow federal as well as state standards. Usual Medigap coverages include: This is an out-of-pocket expenditure that people must pay each time they receive treatment or a medical product, such as a prescription.

With Part B, Medicare usually pays 80% as well as the individual pays 20%. With Component A, there's an insurance deductible that uses to each benefit period for inpatient care in a healthcare facility setup.

Facts About Medigap Revealed

If you need health care solutions while traveling exterior of the United States, it is very important to recognize that Original Medicare does not cover emergency health care services or products outside of the united state Nonetheless, there are some points that Medicare supplement insurance policy normally does not cover, such as vision or dental care, spectacles, hearing aids, private-duty nursing, or lasting care.

Medigap prepares can assist you reduce your out-of-pocket healthcare expenditures so you can obtain economical treatment for click here to find out more thorough health care during your retired life years. Medicare supplement plans might not be best for every scenario, however recognizing your choices will aid you choose whether this type of insurance coverage could aid you handle healthcare prices.

Journalist Philip Moeller is right here to provide the solutions you require on aging and retired life. His weekly column, "Ask Phil," intends to aid older Americans as well as their family members by answering their healthcare and also financial concerns. Phil is the writer of "Get What's Yours for Medicare," as well as co-author of "Obtain What's Yours: The Revised Tricks to Maxing Out Your Social Safety and security." Send your inquiries to Phil; and he will address as numerous as he can.

Everything about What Is Medigap

The most significant void is that Part B of Medicare pays just 80 percent of protected costs. Most likely, more individuals would acquire Medigap strategies if they might pay for the monthly premiums. Virtually two-thirds of Medicare enrollees have basic Medicare, with concerning 35 percent of enrollees instead selecting Medicare Advantage plans.

Unlike other private Medicare insurance policy strategies, Medigap strategies are controlled by the states. And while the details insurance coverage in the 11 different sorts of strategies are dictated by government guidelines, the rates as well as availability of the strategies depend upon state rules. Federal policies do offer assured problem rights for Medigap purchasers when they are brand-new to Medicare as well as in some circumstances when they switch over between Medicare Benefit and standard Medicare.

Nonetheless, once the six-month period of government mandated rights has actually passed, state regulations take control of identifying the civil liberties individuals have if they wish to get new Medigap plans. Below, the Kaiser table of state-by-state regulations is important. It ought to be a necessary stop for anybody thinking of the function of Medigap in their Medicare plans.

Some Known Details About Medigap Benefits

I have actually not seen hard data on look at more info such conversion experiences, and also routinely inform viewers to evaluate the marketplace for brand-new policies in Click Here their state prior to they change right into or out of a Medigap strategy throughout open registration. I suspect that fear of a possible problem makes many Medigap policyholders resistant to change.

A Medicare Select policy is a Medicare Supplement plan (Plan A with N) that conditions the payment of benefits, in entire or in part, on using network suppliers. Network companies are companies of healthcare which have become part of a created contract with an insurance provider to offer benefits under a Medicare Select plan.